gift in kind form

In-kind gifts to the Pittsburg State University Foundation must be reported immediately upon receipt to the Office of Development using this form. Some examples of in-kind donations are.

InKind Contributions Gifts in Kind are a kind of charitable giving in which the goods and services themselves are given instead of giving money to the church to buy needed goods and services.

. For example a business may choose to donate computers to a school and declare that donation as a tax deduction. In-kind Donation Form - New York. These gifts may include equipment vehicles materials supplies artwork and other personal property a donor might give to Lane for use in its educational programs or to the LCC Foundation for use in its annual auction or employee campaign.

33 Documents Weight Chart Template. The form is used to provide information for an accurate depiction of the item and to prepare receipts for tax purposes. If you have any questions about our Gifts-in.

Revised 1121 Page 1. Jude Donation Form Sponsorship Application Form Sponsorship Undertaking Form Gift Aid Sponsorship Form. SAMPLE IN-KIND CONTRIBUTION FORMS Page 1 of 5 Instructions.

763-205-1467 Please note tax receipts will not be issued unless all information is complete with signature. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items. Physical items like sports equipment food office supplies.

Gift In Kind Form These forms are to be used to record and receipt non-cash gifts. All Major Categories Covered. Gift-In-Kind Transmittal Form Terms Instructions A gift-in-kind transmittal form must be completed for every gift tangible or intangible.

Instructions for completing the IN-KIND DONATION FORM. Provide detailed information related to the description of the item or service being donated. Select Popular Legal Forms Packages of Any Category.

234 Documents Receipt Template. Services like pro-bono consulting repair work. This document ensures accuracy in accepting a gift to Nova Southeastern University Inc.

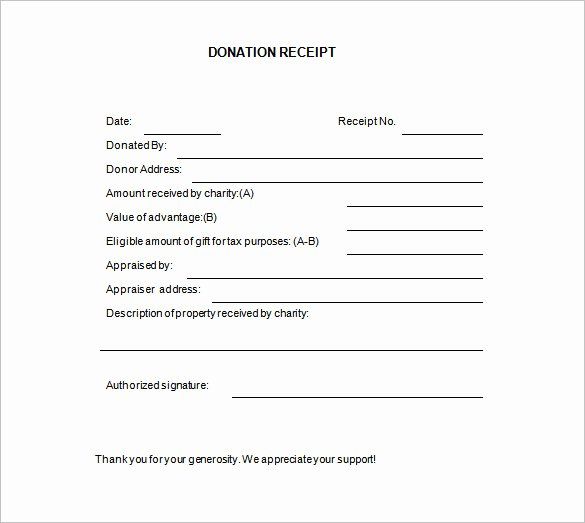

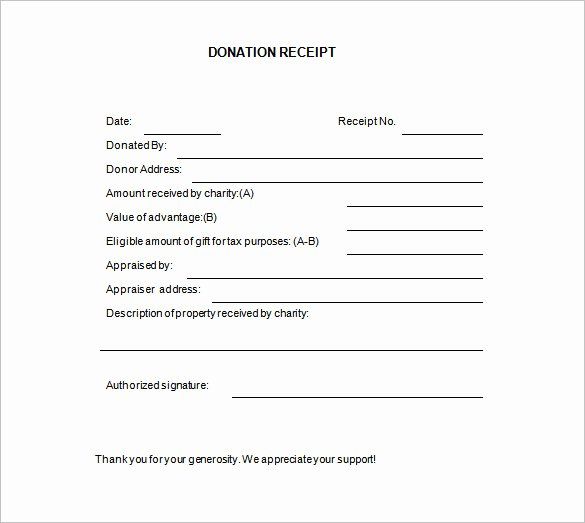

The IRS requires donors to have an official Gift Receipt for gifts of 250 or more before filing tax returns. To see if your potential contribution fits into our collections plan simply fill out the form below and submit to start the process. Those gifts in kind can be linked to asset transfers from the original resource providers to the ultimate resource providers recipients because they are in substance part of the same transaction.

In-kind Donation Form - Texas. 1 Pages In-kind Donation Form - Texas. Those gifts in kind should be reported as contributions and measured at fair value when originally received by an NFP.

Gift-in-Kind Form To ensure we provide a clean and healthy environment for the kids in the hospital only new toys in original packaging can be accepted. This form is for use when a noncash gift is donated to Idaho State University. NSU is a 501c3 not for profit corporation.

Use the templates or a similar form on pages 2 and 3 to document in-kind contributions. Individual OrganizationCompany Name of Organization making the donation. Tax ID No 59-1083502.

In-kind donations are non-cash gifts made to nonprofit organizations. Your organization is not required to use these exact forms. Provide specific project information related to the event being planned including date city and county.

GIFT IN KIND FORM. In-kind gifts of tangible property are reportable on the organizations annual Form 990 under the category of gifts grants contributions or membership fees Certain types of gifts including those valued at more than 25000 or art historical items or other special assets are reported on additional forms. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500.

Please refer to the gift-in-kind wish list for items currently requested. Gift-in-Kind Donation Form Thank you for your interest in donating materials to the University Libraries. Accurate valuation and revenue recognition of nonfinancial gifts commonly referred to as gifts-in-kind or GIK are a challenge particularly for GIK that are used by the NFP for program activities and not subsequently sold in the marketplace.

Individuals partnerships and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than 500. Please print or type the information as legibly as possible. An in-kind donation form is used to collect donations of goods services or volunteer time for a charity or nonprofit.

To receive a tax deduction the donor must obtain a receipt for their in-kind. Complete Gift-in-Kind Form - the donor is required to include their full name address and list of items do-nated including the fair market value or cost of each item. Gifts-in-kind are gifts of property that are voluntarily transferred by a donor to Lane Community College without compensation.

In-kind contributions are third-party donations of goods facilities or services used to meet the matching requirement for an NEA award. The invoice must be certified by the donor and marked Paid in Full by the donor. Documentation from the donor or an independent appraiser valuing the gift is required and should be attached to this form.

1 Pages Related Categories. Gifts-in-kind are gifts of property that are voluntarily transferred by a donor to Grambling State University without compensation. In-kind donations for nonprofits can be made by individuals corporations and businesses.

Proof of Purchase - a Gift-in-Kind will only be processed if a proof of purchase invoice is provided. The completed form should be returned to the ISU Foundation with any supporting documentation. Formal acknowledgment of a gift will be provided by a separate document after acceptance of the gift by NSU.

During the COVID-19 pandemic its more important than ever to organize in-kind donations to directly help those in need so boost your audience and receive more donations online with this free In-Kind Donation Form. Related Categories Hair Donation Form Eye Donation Form Relay for Life Donation Form IRS Donation Form Blood Donation Form Deed of Donation Form St. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Gift-in-kind donations can be delivered to the front desk at the below address Monday Friday from 800 am. In-kind Donation Form - New York.

Get Our Image Of Gift In Kind Receipt Template Receipt Template Marketing Strategy Template Sales And Marketing Strategy

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Donation Letter Letter Templates

Request For Contribution Or In Kind Donation Templates Donation Letter Donation Request Letters Donation Letter Template

Sample Free Donation Form Medical Forms Donation Form Donation Request Form Donation Request

New Gift In Kind Form Stephen Monaco Golf Tournament Donation Form Receipt Template Teacher Resume Template

Donation Receipt Templates 17 Free Printable Word Excel Pdf Samples Donation Form Donation Letter Template Card Template

Pin On Printable Template Example Simple

Browse Our Free Charitable Donation Receipt Template Receipt Template Donation Form Non Profit Donations

Fundraising Form Template Donation Form Sponsorship Form Template Card Template

Sample Donation Pledge Form Medical Forms Donation Form Pledge Donation Request Form

Editable Charitable Contributions Receipt Template Excel Receipt Template Donation Form Business Letter Template

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Letter Templates Donation Form

Browse Our Printable Gift In Kind Receipt Template Receipt Template Donation Letter Template Printable Letter Templates

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Donation Receipt Templates 17 Free Printable Word Excel Pdf Samples Donation Letter Receipt Template Donation Form

Get Our Printable Tax Deductible Donation Receipt Template Receipt Template Tax Deductions Receipt

Donation Form Template Word Elegant Blank Receipt Template 20 Free Word Excel Pdf Vector Receipt Template Donation Letter Template Donation Letter